SUMMARY

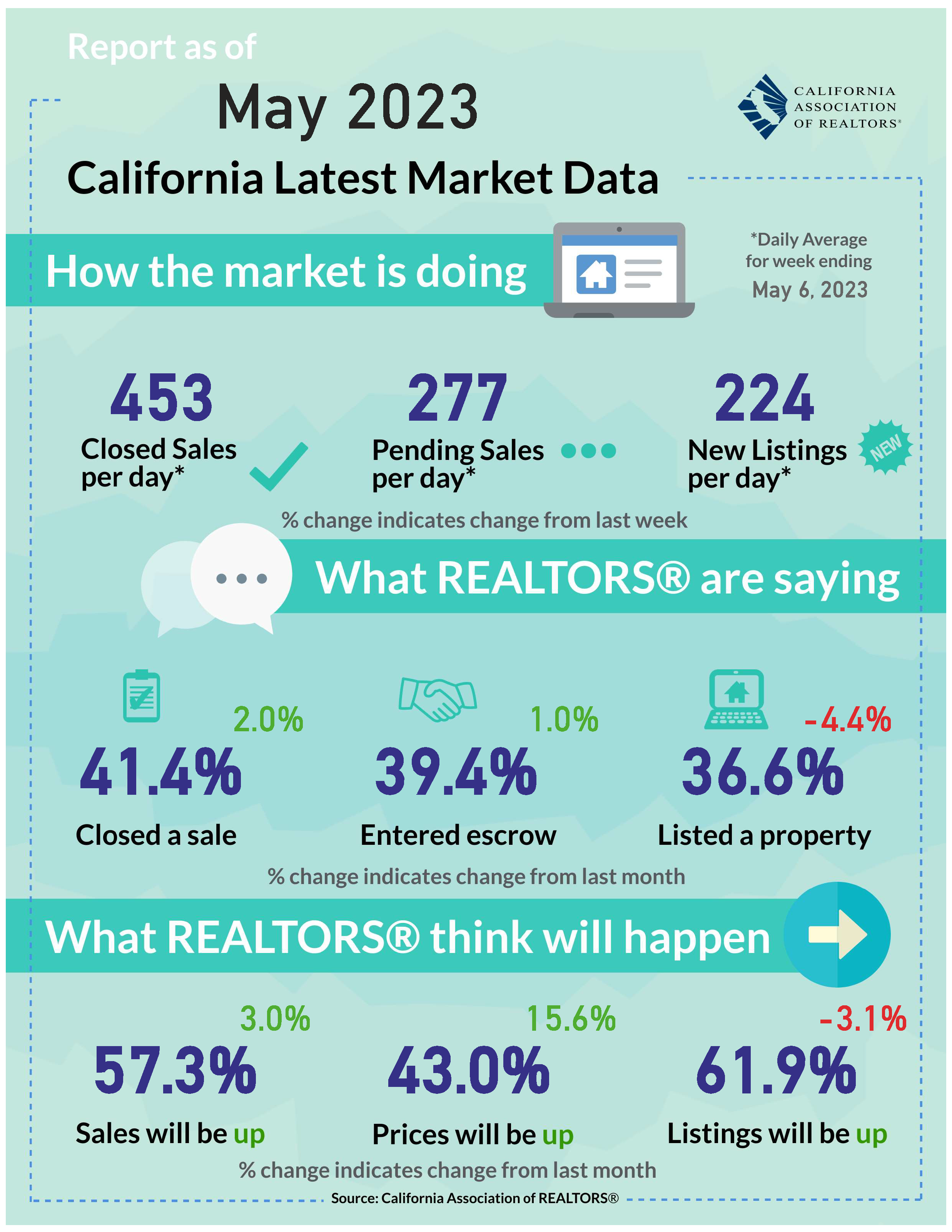

Despite the challenges the California housing market has faced, such as tight inventory, recent banking turmoil, and concerns over economic growth, market activity is gradually increasing. The share of those having listing appointments, entering escrow, and closing escrow increased from the previous month, with new escrows and closed sales at seven and nine-month highs, respectively. While the market has seen a slowdown in hiring momentum and job openings, the labor market remains tight. The state’s housing growth increased by 0.85%, but more is needed to meet California’s population demands.

California Housing Market Improving Slowly But Faces Tight Inventory Challenge

Total Spending Advances Despite Heightened Economic Uncertainty

The construction spending in March increased by 0.3%, reflecting a year-over-year gain of 3.8%. However, the growth in overall spending concealed the residential and non-residential sectors’ contrasting trends. Residential spending declined 0.2%, continuing its 10-month decline and running below last year’s levels by 9.8%. Single-family activity continues to be the biggest drag on residential spending, decreasing by 0.8% from February and 22.9% behind a year ago. This is attributed to high-interest rates, inflation, and higher development costs. Builders have reported these factors as impediments to growth.

Fed Raises Rates By 25 Bps and Hints at a Potential End to Hikes

The Federal Open Market Committee (FOMC) has approved a 10th interest rate hike on its benchmark borrowing rate by 0.25 percentage points, taking the fed funds rate to a target range of 5%-5.25%. Although the FOMC has hinted at a potential end to the tightening cycle, recent banking turmoil and concerns over economic growth have rattled nerves on Wall Street and Main Street. The Fed has acknowledged that inflation continues to run high despite moderating somewhat. It is still the primary focus for the Fed, and the path ahead will depend on incoming data and financial conditions.

Labor Market Remains Tight Despite Recent Directional Slowdown

The US economy added 253,000 jobs to its payroll in April, keeping the labor market tight despite the supply picture’s recent improvement. The labor force participation rate was essentially unchanged, and the unemployment rate fell to 3.4%, on par with a 53-year low. However, the momentum in hiring has slowed, and job openings have been trending lower. These indicators show that the Fed’s intervention is beginning to normalize the roughly two-year labor shortage.

California’s Population Decline Slows While Housing Grows

As of the beginning of the year, California’s population is estimated to be 38,940,231. Factors such as stable births, fewer deaths, and a rebound in foreign immigration slowed California’s recent population decline in 2022. The population decline of 0.35% in 2022 marks a slowdown compared to the previous year, where the population decreased by 0.53%, equivalent to 207,800 persons. The state’s housing growth increased by 0.85%, the highest level since 2008; it is not enough to meet California’s population demands for housing to reduce high rents and housing prices seriously.