US Pending Home Sales Show Signs of Recovery

“The recovery has not taken place, but the housing recession is over.” – Lawrence Yun, NAR Chief Economist

Key highlights

- US pending home sales rise 0.3% in June, the first increase since February.

- NAR Chief Economist, Lawrence Yun, declares the housing recession is over.

- Inventory shortage remains a challenge for potential homebuyers.

- Mortgage rates may offer relief amid rising home prices.

August 2, 2023

Contracts Picking Up Pace

Good news for home buyers! The housing market is showing signs of bouncing back, as contract signings for previously owned homes increased in June. This is the first rise since February, hinting at a possible recovery from the recent downturn.

Demand on the Rise

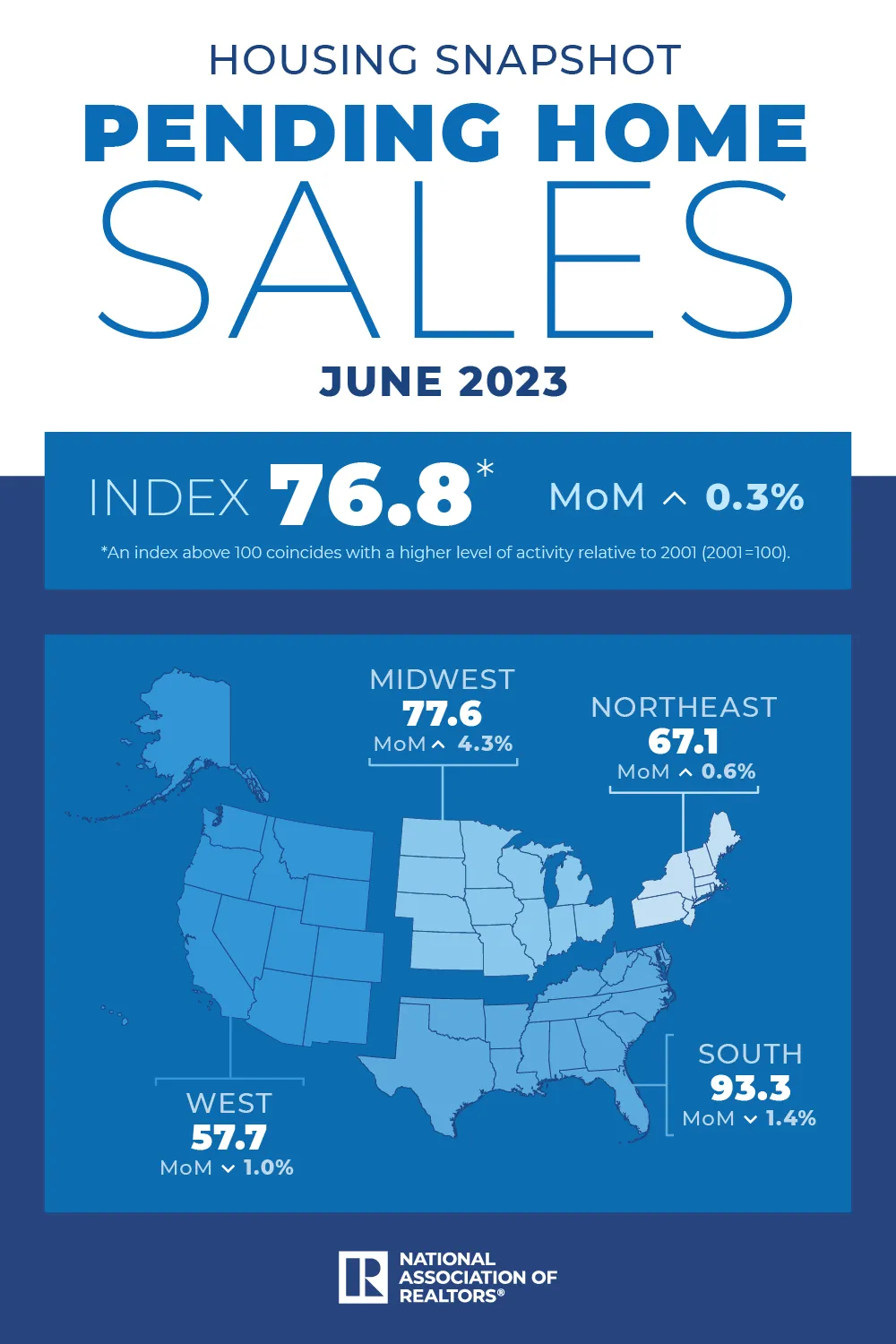

The National Association of Realtors (NAR) reported a 0.3% increase in the Pending Home Sales Index, based on signed contracts that will become sales in the next month or two. This upbeat development defied economists’ expectations of a 0.5% decrease in contracts.

Bottoming Out

Although June’s pending home sales were still down 15.6% compared to the same month last year, experts believe the housing market is reaching its lowest point and is poised for improvement.

“Housing Recession is Over”

NAR’s chief economist, Lawrence Yun, shared some encouraging news: “The recovery has not taken place, but the housing recession is over.” Multiple offers on homes indicate high demand, fueled by a shortage of available properties.

Inventory Shortage Driving Homebuilding

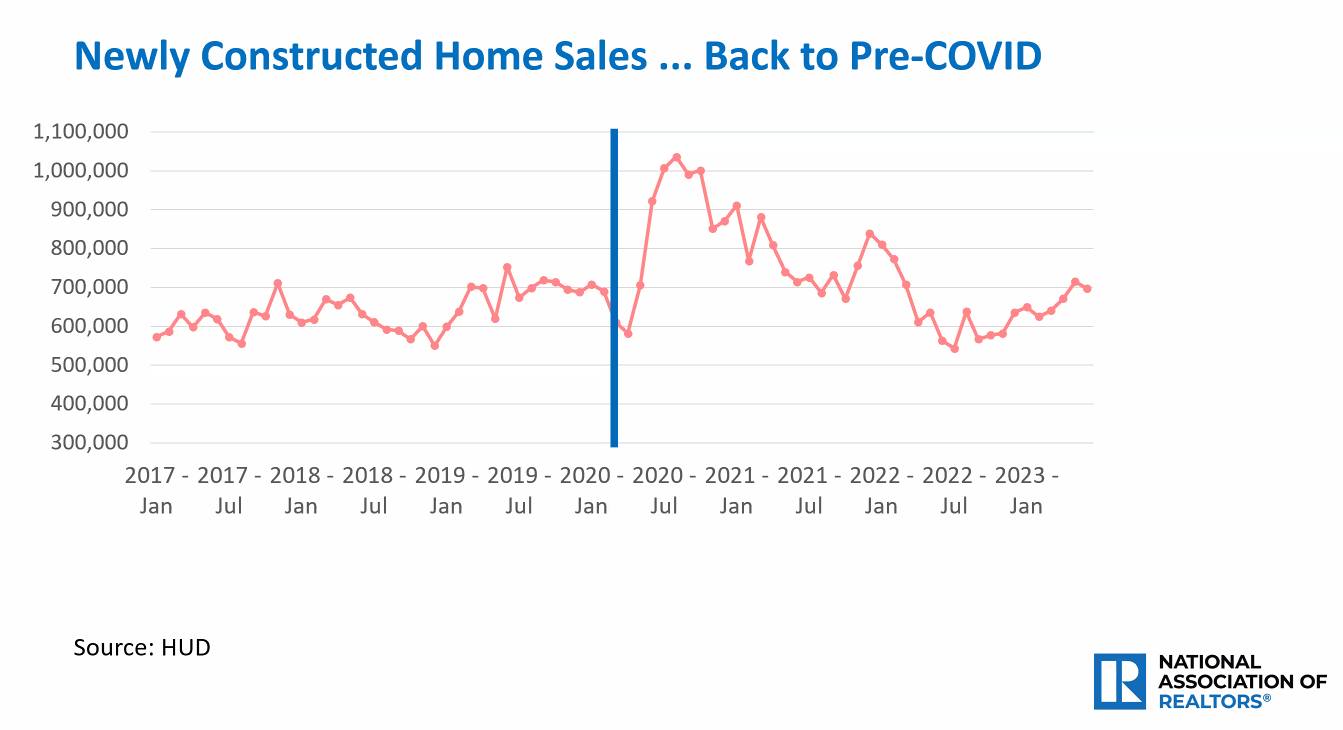

Existing home inventory remains historically low due to locked-in mortgage rates below 5% for many homeowners. Consequently, homebuilders are ramping up production and hiring more workers to meet the demand.

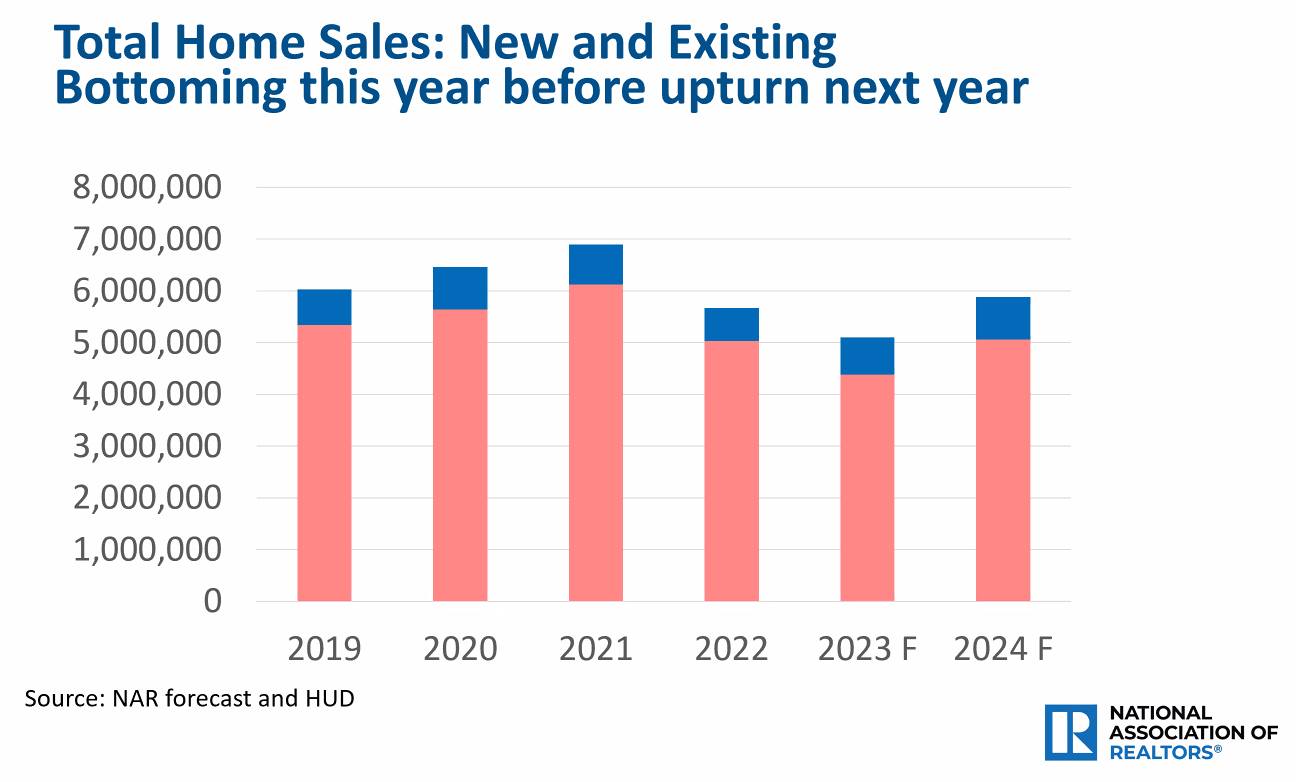

Existing-home sales are down 23% from last year, below pre-pandemic levels. However, new home sales are back to pre-COVID levels. – Dr. Yun

Looking Ahead: Mortgage Rate Predictions

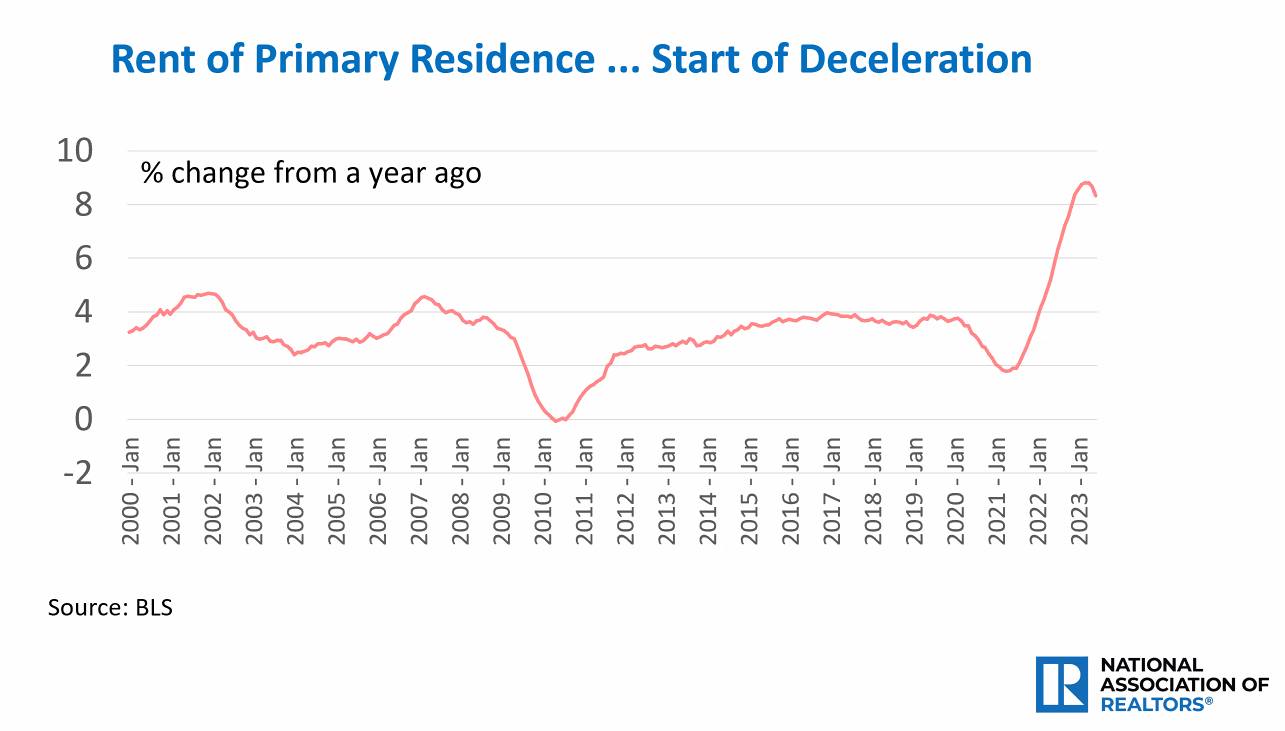

The NAR predicts that the 30-year fixed mortgage rate will decline to 6.4% this year and further to 6.0% in 2024, easing the burden for potential buyers.

Federal Reserve’s Influence

The housing market’s recent resilience is also influenced by the Federal Reserve’s decisions on interest rates. Federal Reserve Chair Jerome Powell indicated that further rate hikes are possible in the upcoming months.

Market Forecast

NAR forecasts that existing-home sales will dip by 12.9% in 2023 compared to 2022 but will rebound with a 15.5% increase in 2024. Median existing-home prices are predicted to remain steady this year, with a 0.4% decrease compared to 2022, before rising by 2.6% in 2024. New-home sales are expected to increase by 12.3% in 2023 and an additional 13.9% in 2024, with the national median new-home price falling by 1.9% in 2023 before rising by 4.2% in 2024.

Regional Variations

Although overall pending home sales were down 15.6% in June compared to the previous year, some regions experienced positive monthly growth in contract signings. The Northeast and Midwest saw an increase, while the South and West reported a decrease in contract signings.

In conclusion, the housing market is showing promising signs of recovery, but the low inventory remains a challenge. With mortgage rates stabilizing and homebuilding on the rise, prospective home buyers may find some relief in the coming months. However, supply constraints continue to impact prices, and the housing market’s performance remains subject to the Federal Reserve’s decisions on interest rates.

Dustin Balloun, Ventura County Coastal Association of REALTORS®