California Housing Market Forecast: Tight Supply and Optimistic Outlook

The California housing market grapples with tight supply, resulting in fewer sales and high home prices, while affordability remains a challenge. However, there are positive signs as builders continue to forge ahead with new constructions, and consumer sentiment shows improvement, offering hope for a more balanced market.

KEY HIGHLIGHTS

- Tight supply continues to impact the California housing market, leading to fewer sales and high prices.

- Builders show confidence as residential constructions surge, aiming to meet the growing demand.

- Mortgage rates remain high due to central bank decisions, but experts predict a decline in the year’s second half.

- Rent growth moderates, and consumer sentiment improves, driven by easing inflation concerns and a brighter economic outlook.

June 27, 2023 – The California housing market continues to face challenges as tight supply weighs down the market, resulting in fewer sales, high home prices, and low housing affordability. This means it’s getting harder for the average person to find their dream home at an affordable price. The lock-in effect prevents potential home sellers from selling their properties, further exacerbating the housing supply shortage.

Developers, however, see an opportunity in this situation. Residential constructions have been on the rise in recent months as they aim to meet the growing demand for housing. Despite the increase in new homes being built in the first half of the year, the overall housing supply in California has yet to see significant improvement. This constraint is expected to persist in the short term, keeping the housing market tight.

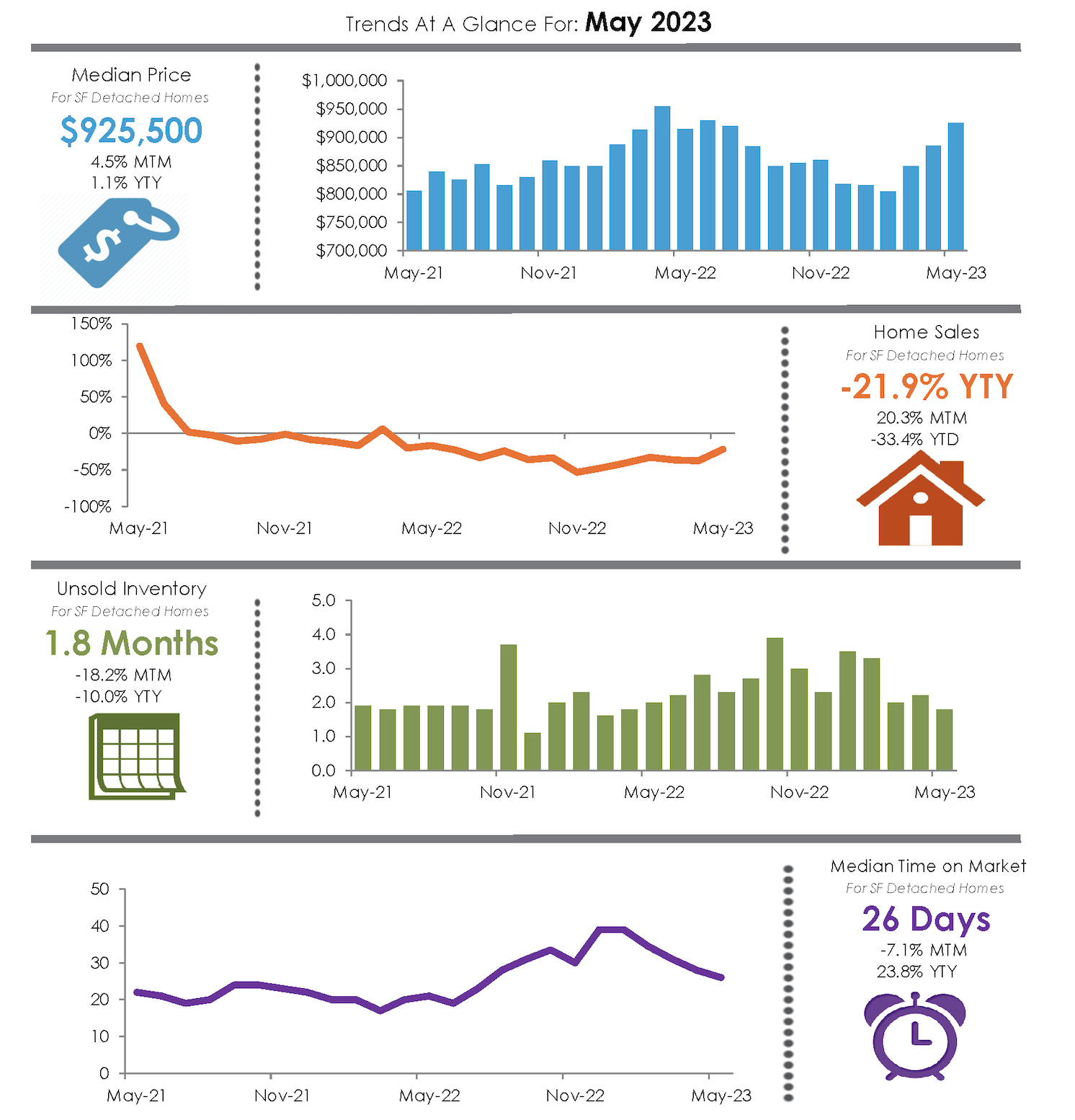

Supply Drops, Putting Pressure on Buyers: After a brief bounce back in April, housing supply tightened up again. Mortgage rates remained high, and potential home sellers stayed on the sidelines. In May, the number of new active listings for existing single-family homes statewide was nearly 30% lower than the previous year. Although there was a 19.0% increase in new active listings compared to April, it still fell behind last year’s numbers by a significant margin. The slight improvement in the upcoming month’s unsold inventory index will be driven by changes in demand rather than supply.

Central Banks Influence Interest Rates: Mortgage rates have been relatively stable recently, following a peak in late May and early June. Central banks, including the Federal Reserve, have announced plans for rate hikes, which have kept interest rates from falling. However, with the expectation that inflation will ease by the year’s end, mortgage rates will likely decline in the second half of 2023. Some experts even predict that the average 30-year fixed-rate mortgage could drop below 6% by the end of the year, providing some relief for potential homebuyers.

Builders Show Confidence Amidst Challenges: Homebuilders remain cautiously optimistic about the housing market despite the high-interest rates. Residential constructions gained momentum in May, with a surge of over 20% in housing starts compared to April and almost 6% compared to last year. While the Midwest and South regions experienced double-digit growth in single-family starts, the Northeast region saw a nearly 9% increase. However, the West was the only region to experience a decline in housing starts from the previous month. Building permits at the national level also showed moderate growth from April but a drop from last year. Developers are becoming more hopeful as existing housing stock remains limited and conditions on the supply side continue to improve.

Rent Growth Moderates: Rent growth for single-family homes in the U.S. slowed down in April, with a year-over-year gain of 3.7%, significantly lower than the 14.2% increase observed in the same month of the previous year. CoreLogic reported that all metropolitan areas tracked showed single-digit rent growth, except for Las Vegas, which experienced a slight decrease. Rent growth has been decelerating throughout the year, and with more multifamily supply entering the market, it is expected to decline further. The West region could see more substantial drops in rent compared to other areas.

Consumer Optimism on the Rise: Consumer sentiment saw a significant jump of 8% to reach its highest level in four months, according to a survey by the University of Michigan. The easing concerns about inflation and an improved economic outlook contributed to this positive shift in consumer sentiment. Resolving the debt ceiling issue and temporary relief from the banking crisis also boosted optimism. The narrowing gap between wage growth and inflation also added to the brighter economic outlook. Consumers felt more optimistic about the price trend, with their short-term inflation expectations reaching the lowest reading since March 2021. Despite a 28% increase compared to the record low from a year ago, consumer sentiment remains below historical standards.

While the California housing market faces challenges due to tight supply and high prices, there are signs of optimism. Builders are forging ahead with new construction projects, and consumer sentiment is rising. However, it’s important to note that the housing supply shortage is expected to persist in the short term, impacting affordability and creating a challenging environment for homebuyers.

Dustin Balloun, Ventura County Coastal Association of REALTORS®