July, 25 2023 – The Market Minute is an analysis that offers the most up-to-date information on the economy and the housing market. It provides critical highlights and concise insights on industry-related issues every week.

California Housing Market Faces Challenges Amidst Rising Interest Rates and Tight Supply

Introduction:

The California housing market faces a dynamic landscape with its fair share of challenges and promising developments. As interest rates hover near 7%, the economy soldiers on, and inflation shows signs of cooling. However, the Federal Open Market Committee’s upcoming meeting may bring rate hikes, impacting mortgage rates in the short term. Despite these uncertainties, consumer sentiment and businesses are ramping up, showcasing resilience in adversity. Let’s delve into the latest updates and explore the current state of the California housing market.

Inflation Cools, but Fed Still Eyes Rate Hike

Markets were pleasantly surprised as inflation dipped to a two-year low of 3% annually. Despite this improvement, many expect the Fed to raise interest rates at least once, with the Fed Funds Rate potentially reaching 5.5%. This move may help avoid a second rate hike soon. The cooling service sector prices have been crucial for economic growth, and while some hope for reduced monetary policy, the Fed may take a cautious approach.

Consumer Sentiment Soars, Businesses Optimistic

Consumer sentiment soared to a two-year high as fears of recession faded, bolstered by a robust labor market. Although inflation remains a concern, consumers are more optimistic about their financial prospects. Businesses also share this optimism, with reduced worries about a pending recession. Economic data continues to be upbeat, supporting their positive outlook.

California Labor Markets Stay Strong

Despite initial crises faced by some financial firms and tech companies in California, the state’s labor market remains resilient. Jobs continue to be added, particularly in the service sector, where consumers’ spending remains steady. Unemployment insurance claims have significantly declined since April, signaling a positive trend, with fewer workers on unemployment insurance since 2022.

Freddie Mac Reports Elevated Rates

The average 30-year fixed-rate mortgage rose to 6.96%. While inflation data may influence future rates, there’s hope for a faster return to less aggressive monetary policy or even rate cuts next year. The yield curve remains inverted, impacting rates differently than expected with the current Fed Funds Rate.

Mortgage Applications Indicate Seasonal Changes

New mortgage purchase applications saw a dip, following typical seasonal patterns. However, in recent years, California’s homebuying season has extended into the fall. As we approach the 4th quarter, stable or rising home sales may still be in store for the market.

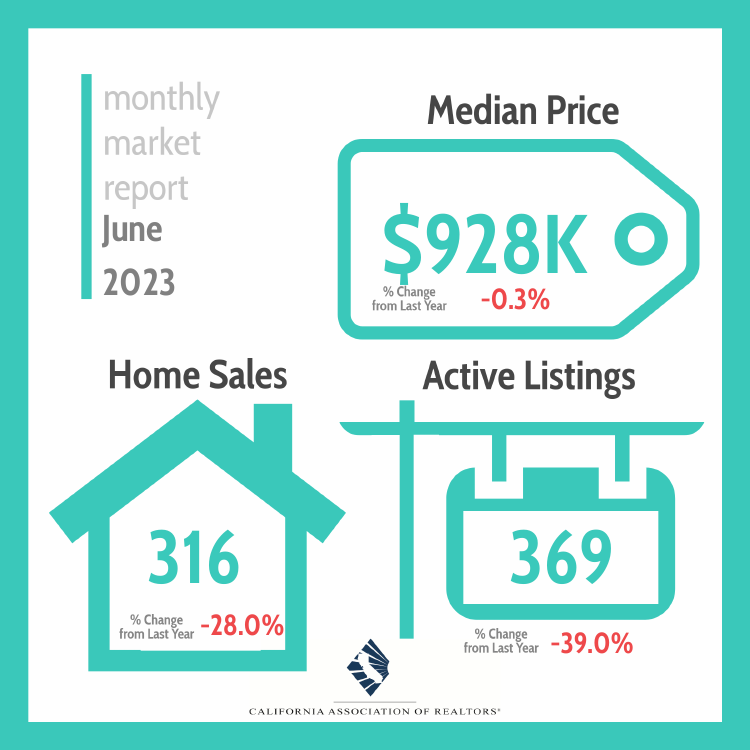

June Home Sales Moderate with High Median Price

June saw home sales fall below the 300,000 benchmark for the ninth consecutive month, while the median price remained above $800,000. Expectations of monthly price dips in the coming months are anticipated, given the typical seasonal patterns and elevated rates in the third quarter. The solid economy may delay the Fed loosening its monetary policy, which could impact mortgage rates.

Elevated Rates and Limited Supply Impact Home Sales

Home sales in California continued to decline on a yearly basis but with the smallest drop in over a year. The combination of tight supply and high mortgage rates puts pressure on home prices, impacting the overall market. As we approach the end of the homebuying season, the market may see some improvement in affordability if interest rates come down.

Supply Stagnates Amid High Mortgage Rates

Housing inventory in California remained tight, with slight improvement from last year. Active listings fell sharply, signaling a limited supply condition for the rest of the third quarter. High mortgage rates contribute to the stagnation in supply, adding to homebuyers’ challenges.

Retail Sales Climb, but Easing Momentum

Consumers continued spending, boosting retail sales for the third straight month. However, the pace of growth slowed compared to previous months. E-commerce remained a bright spot, indicating a positive trend for the retail sector.

Single-Family Rent Growth Normalizes

Single-family rent growth continues to be positive, with an annual increase of 3.4%. The trend is similar to pre-pandemic levels, providing relief for renters after facing double-digit growth rates in previous months. Rent growth has been slowing throughout the year, with expectations of further softening as more multifamily supply comes into play.

Builders Confident Despite Residential Construction Dip

Residential construction faced a dip in June, partly offsetting the robust gain in May. However, single-family permits continue to rise, indicating positive prospects for the construction sector. Builders remain confident, focusing on single-family housing units. The market’s outlook remains hopeful, with a continued rise in builder confidence.

The California housing market navigates through challenges driven by interest rates and supply constraints. However, resilient consumer sentiment, businesses, and labor markets provide bright spots in an ever-changing landscape. As we approach the end of the year, the market’s dynamics continue to evolve, offering both challenges and opportunities for buyers and sellers alike.