THE VCCAR DIFFERENCE

BECOME A MEMBER

calendar

NEWS

MARKET REPORTS

2024 Dues Renewal

Association dues are payable by January 16, 2024. Prompt payment is essential to avoid any disruptions or limitations to your account and business operations. Should you have any inquiries or require assistance, our office is readily available to help. You can reach us at 805-981-2100. Thank you for choosing VCCAR!

Payment Options

VCCAR offers a payment plan for Association dues.

Remove the hassle of big bills during the holiday season and opt-in

to four easy automated payments for worry-free dues renewal.

$791

ONE ANNUAL PAYMENT

One time payment made by

due January 3, 2024

Pay by January 15, 2024 to avoid a late

fee or reinstatement fee.

$315

(FIRST PAYMENT)

PLUS 3 ADDITIONAL QUARTERLY PAYMENTS

Requires automatic debit of quarterly payments.

Q2: $246.00 | Q3: $185.00 | Q4: $185.00

REVIEW PAYMENT OPTION BREAKDOWN

Return Completed Forms to

Alexandra Varney, Accounts Receivable Clerk.

Please Note: Dues and fees are non-refundable. Refunds are not honored once payment is submitted.

BREAKDOWN

$300 VCCAR

$231 C.A.R. & REALTOR® Action Assessment*

$201 NAR Allocation & Assessment

** $49 REALTOR® Action Fund (RAF) (optional)

$10 C.A.R. Housing Affordability Fund (optional)

———————————

$791 TOTAL

Quarterly payment plans auto debit on:

- March 15

- June 15

- September 15

* The REALTOR® Action Assessment ($69 of the $231) will automatically be deposited into CREPAC, CREIEC, and/or IMPAC and used for other political purposes. Those wishing to have their assessment entirely applied for more general political purposes may specify in writing, and it will be redirected to a different account instead of one of the dedicated California real estate PACs (CREPAC, CREIEC or IMPAC). Designated REALTORS® must pay the $69 REALTOR® Action Assessment for each licensee of that DR (as shown in the nonmember count), and the payment will be attributed to the Designated REALTOR®.

** Make a difference by helping promote REALTOR® interests through the political process and designate an additional $49 or more to the REALTOR® Action Fund. $49 is the suggested additional voluntary contribution but you may give more, or less, or nothing at all. See additional information on the political contribution structure and allocation located as Legal Notices under Dues & Fees.

POLITICAL CONTRIBUTIONS

Political contributions are not deductible as charitable contributions for federal and state income tax purposes. Dues payments & assessments (Local Association, CAR, and NAR) and contributions to “REALTOR® Action Fund” are not tax deductible as charitable contributions at the Federal level. Contributions to the CAR Housing Affordability Fund are charitable and tax-deductible to the extent allowable under both Federal and State law. Payments, excluding the portion of dues used for lobbying activities and REALTOR® Action Fund, may be deductible as ordinary and necessary business expenses. Please consult your tax professional.

LOBBYING

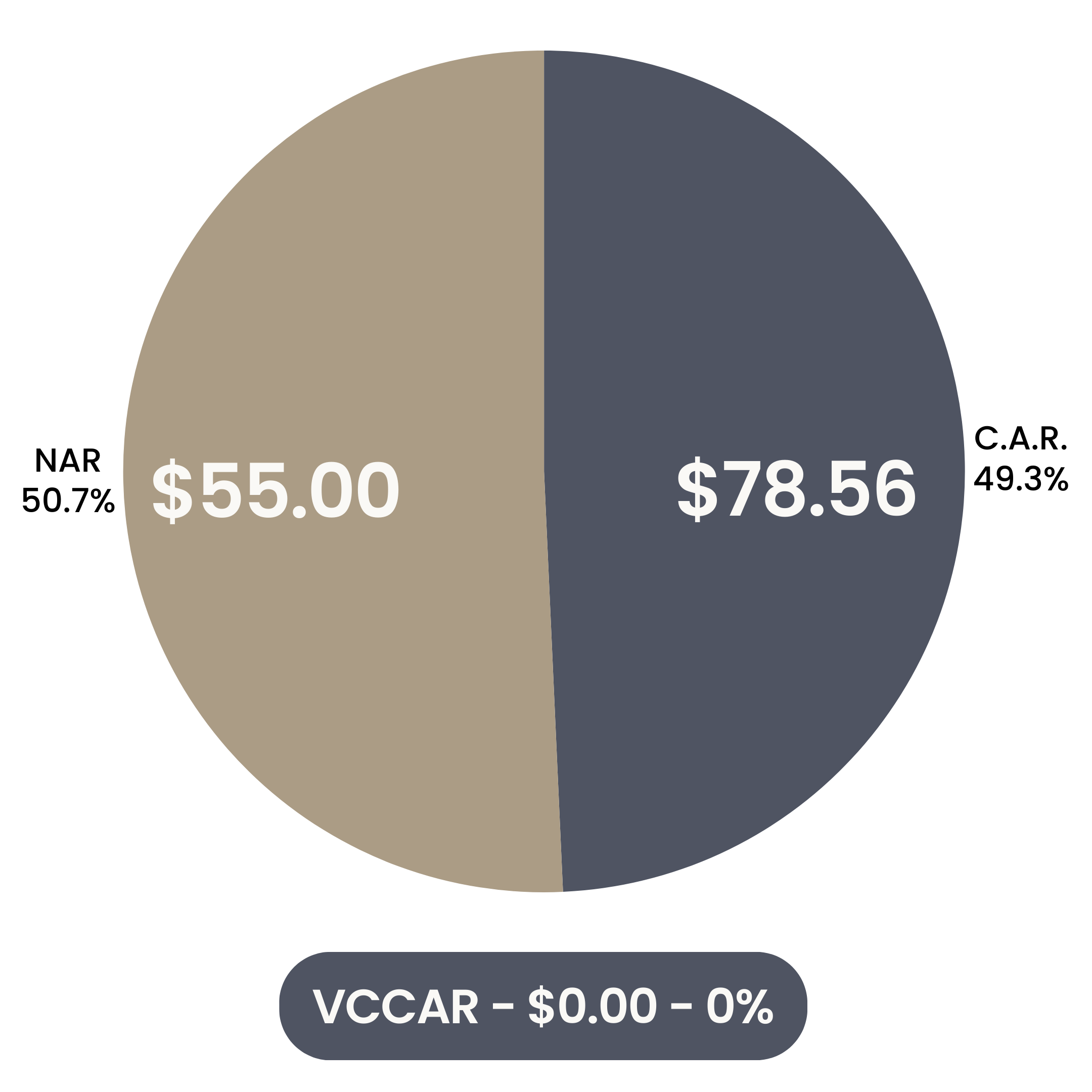

2024 Estimated Portion of Your Dues Used For Lobbying That Is Non-Deductible: $133.56.

NAR – $55.00 35%

CAR – $78.56 34%

VCCAR $0.00 0%

Key Deadlines

- January 3 – Payment due January 3, 2024

Pay by January 15, 2024 to avoid a late

fee or reinstatement fee. - January 16 – January 31: Unpaid invoices will now include a $50 late fee.

- February 1 – February 14: Unpaid invoices will now affect your membership status. Your status will change to NON-MEMBER and a reinstatement fee will be added to your account. Reinstatement fees are $100 for REALTORS® and $150 for Designated REALTORS®.

- February 15: Remaining unpaid invoices will trigger member TERMINATION.

- March 1: Unpaid members will incur a $50 C.A.R. late fee. (Last day to pay without a C.A.R. late fee is Feb. 29, 2024)

Non-Deductible

Dues Portions

2024 Estimated Portion of Your Dues Used for Lobbying That Is Non-Deductible: $133.56

NAR – $55.00 35%

C.A.R. – $78.56 34.01%

VCCAR – $0.00 – 0%

Robin Morris

e-PRO®, C2EX, AHWD

VP Finance & Administration

P: 805-981-2100 x103

D: 805-214-4996

F: 805-981-2107